Platform banking: A key tool in the bank's arsenal to stay competitive

One of the disruptions from the COVID-19 pandemic was an unprecedented shift of consumers to online channels. As the world locked down, people had no choice but to leverage digital channels to conduct their day-to-day transactions. And most of them found they liked the ease and convenience of a digital platform. Consumers now wanted a single place – a virtual marketplace – where they could conduct most of their transactions effortlessly. Enter platform banking.

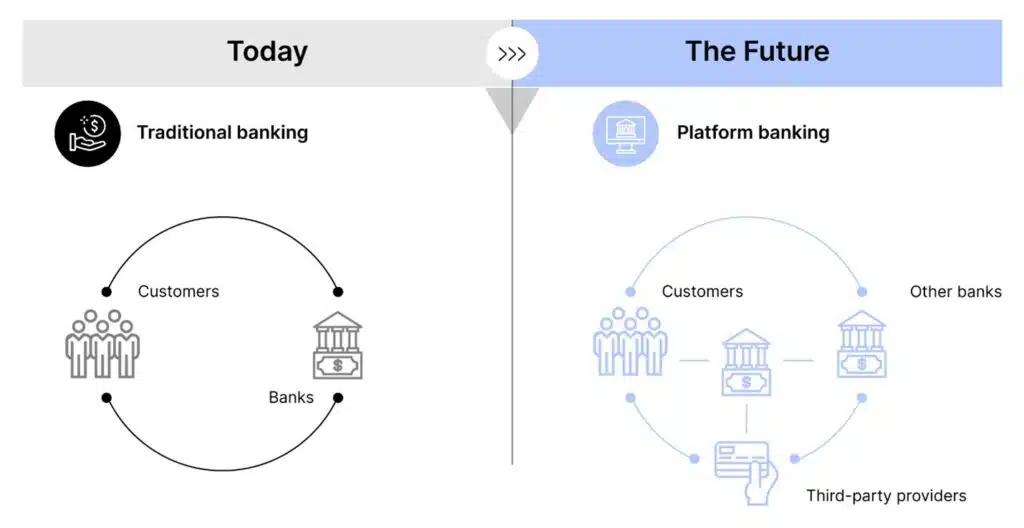

Platform banking refers to digital marketplaces owned and operated by banks, financial institutions, or even non-banking entities where customers can transact to avail of banking and non-banking products and services.1

The rise of platform banking

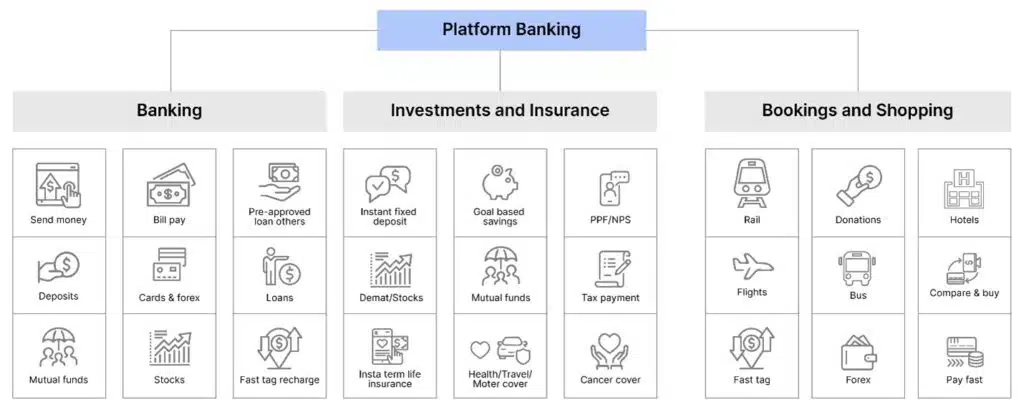

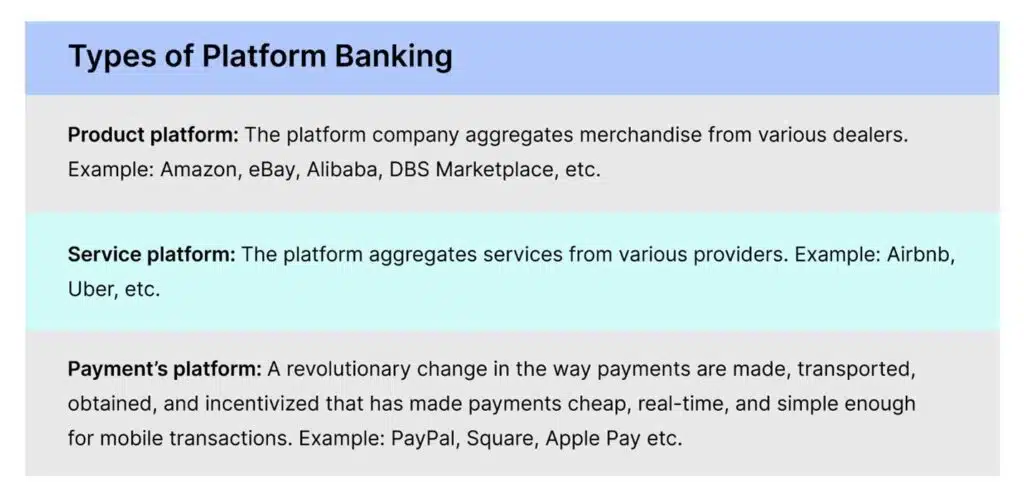

In the East, super apps – a single platform for multiple products and services – were already on the rise, with WeChat and Alipay enabling billions of transactions2. The ease and convenience of having everything in one place make them appealing to the users. Changing consumer behavior and more trust in these mobile platforms is heralding a change for traditional banks. A Deloitte3 survey found that approximately a third of retail bank customers in the United States are interested in a platform banking service offered by their primary bank. Over half the respondents in the survey were also opened to using a banking super app. Platform banking has become the go-to method for users to make deposits, account transfers, and monitor their spending and earnings and booking tickets, shopping etc. – and a key differentiator for banking leaders. When owned by the bank, a digital platform can connect its users to many financial and non-financial services with the robustness and governance banks are known for. The services on this platform will give rise to new apps, some created by the bank, some by other players, but all integrated on one platform.

Platform Banks recognize that change is needed if they want to stay competitive, given the new entrants in the banking landscape. Several banks in the US and ROW have already launched platforms to meet this demand. For instance, Kaspi Bank’s marketplace enables a seamless shopping experience with payment and credit options during the purchase. BNY Mellon launched its NEXEN platform in 2015 to integrate customers, third-party partners, and BNY Mellon’s services, such as asset custody, broker-dealer services, and alternative investment services, into one app. Capital One offers APIs to enable merchants to make customized offerings to their customers, which can be paid with loyalty program points. DBS has launched a car marketplace, integrating different dealer platforms, supporting transactions, and offering financing and insurance.

Why banks should focus on platform banking

Since the start of the coronavirus pandemic, mobile capabilities have become a more significant factor in bank selection among customers than in the previous year. In addition, new entrants in the financial services industry have brought in new tech capabilities, retail experiences, and self-service functionalities that customers crave. Staying competitive requires banks to play an active role in the platform banking world to create new sources of revenue, enhance customer experience and retention, and improve operational efficiency. Entering the platform banking space can offer banks:

- Scalability – Platforms allow banks to reach customers they previously couldn’t. They can scale beyond banking by integrating into other platforms and creating a network with lower customer acquisition and product distribution costs.

- Data – Banks can leverage the transaction data to better understand customers’ needs and give them contextual experiences and recommendations.

- Value – Once engaged on the platform, the customer can be connected to related products in an intuitive product offering ecosystem. For instance, a mortgage customer could be directed to offerings on home furnishings, buildings insurance, garden supplies, etc.

Preparing for a platform world

There is a lot that can be done in the platform space. First, however, banks must analyze what their customers value most and where they stand compared to their competitors to pinpoint focus areas. Selecting the right marketplace and partners needs critical consideration. Several dimensions such as their product choice and quality, capacity to serve clients seamlessly, risk profile, financial strength, and brand reputation must be considered before selecting partners. Other factors, along with revenue-sharing models and allocation of risk ownership between the platform operator and the provider company, are also key to success.

Platform banking is the future and banks that take steps now to embrace it will have the first-mover advantage over their counterparts.

- https://bfsi.economictimes.indiatimes.com/news/banking/what-is-platform-banking/85359191

- https://home.kpmg/xx/en/home/insights/2019/06/super-app-or-super-disruption.html

- https://www2.deloitte.com/us/en/pages/financial-services/articles/platform-banking-as-a-new-business-model.html

Authored By: Kulpreet Kaur