The Banker's Guide to Embedded Finance

When was the last time you went to your bank’s portal to complete a transaction? Think about it. You wanted the latest smartphone and looked around for the best deal on online marketplaces. You got a great deal on Amazon and add that to your cart. With a simple click, you get several options on how you want to pay for it – credit and debit cards, Amazon Pay, UPI, Net banking, and even zero-cost EMIs. You’ve just experienced embedded finance.

And Amazon is not alone. Players in eCommerce, big tech, mobility, and SaaS space are making quick strides into this space. For instance, Grab, a big player in the mobility space, has partnered with Adyen and Stripe to create an ecosystem of financial products under one app. Similarly, Big Tech players have entered the embedded finance space with services like Apple Pay and Google Pay.

The future is embedded

Embedded Finance or embedded banking is the seamless integration of financial services into a traditionally non-financial platform. It removes the need for businesses to create fintech arms to offer financial services and reduces the barrier to entry.

Embedded finance has become one of the hottest trends in the fintech space today.

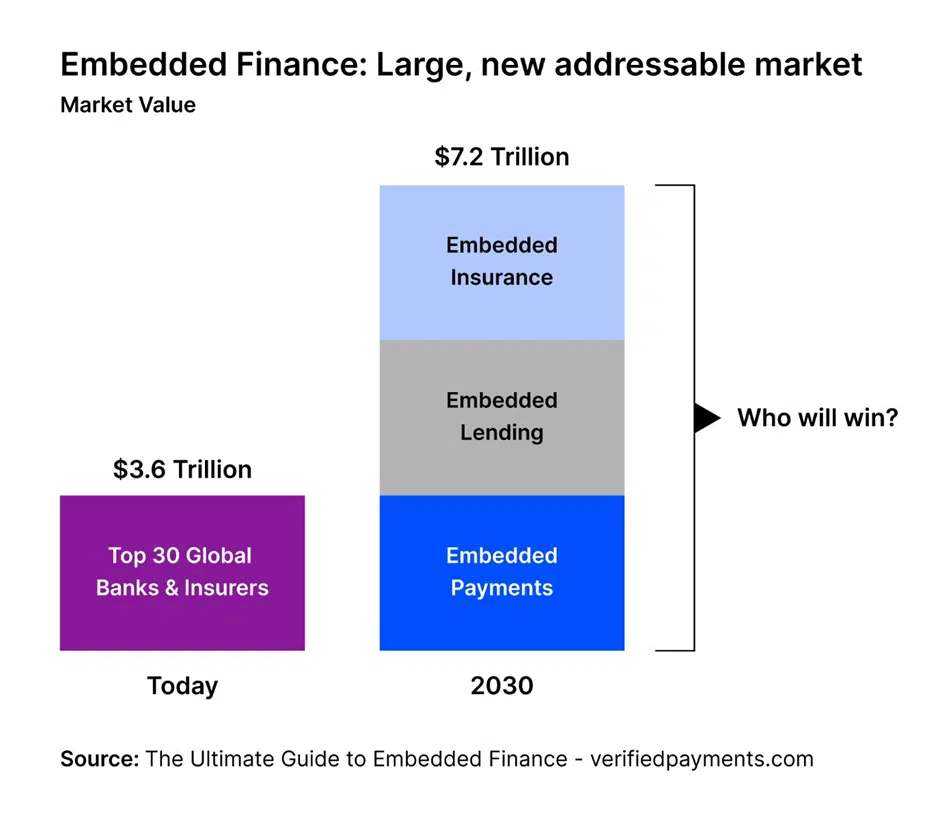

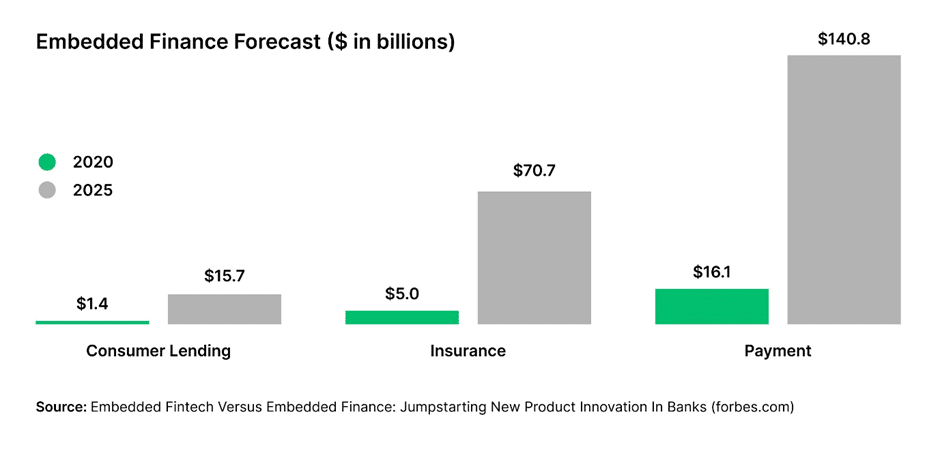

A report by Oracle[i] predicts that by the end of this decade, the embedded finance market will grow to US$7 trillion in value – twice as much as the collective value of the world’s top 30 banks at present (See Fig)[ii]. In addition, private equity firm Lightyear Capital predicts that revenues from embedded finance will increase 10x, surging to an estimated US$230 billion by 2025 (See Fig)[iii].

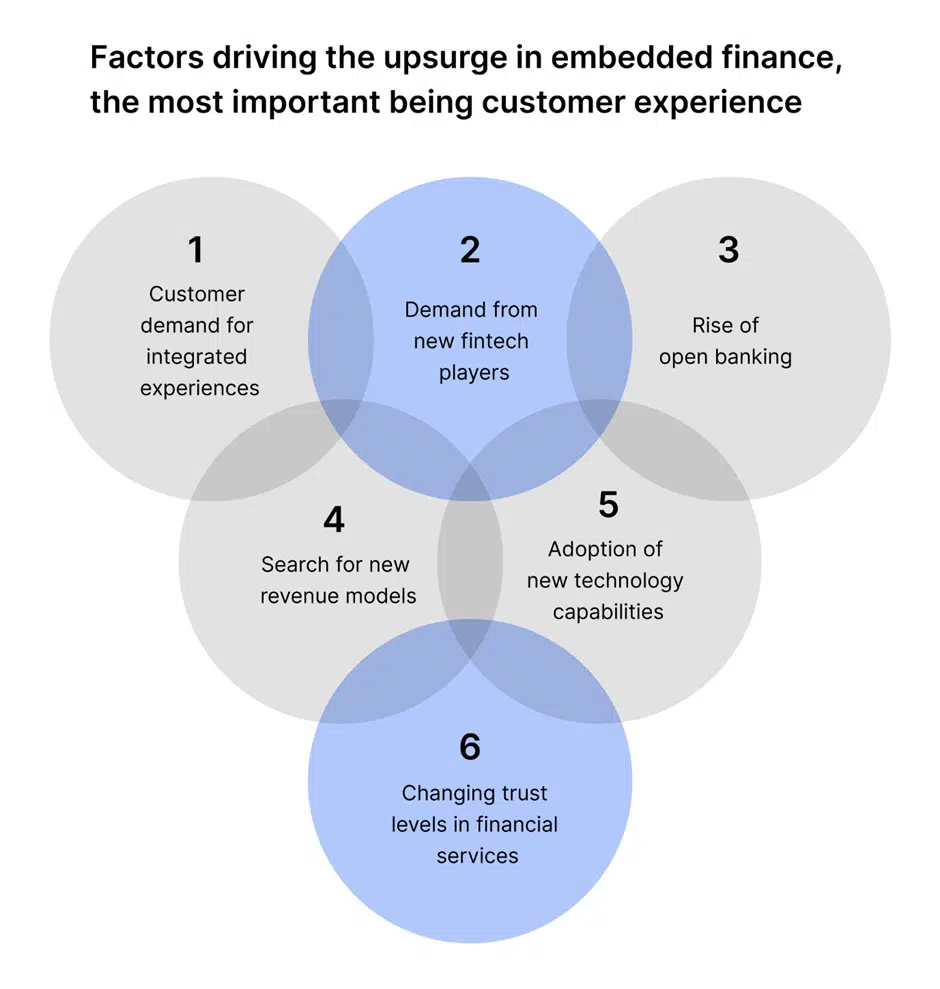

Digital savvy customers want seamless, contextual experiences and simpler user journeys. They want the ease of transactions and “right here, right now” gratification. They are willing to offer their trust to these platforms for the promise of security and convenience. And non-financial platforms have recognized this opportunity. Today you have flexible finance available at the point of sale, the option for instant insurance when you rent a car, book a flight, or visit a doctor, and even mortgages available within real-estate apps.

The retail sector is abuzz with multiple online marketplaces that enable in-app payments via e-wallets, cryptocurrencies, credit cards, micro-loaning apps, etc. Consumers love the experience and over time trust the platform. The convenience of saved information keeps them coming back for the seamless payment experience.

While retail is the poster child for embedded finance, other industries are not far behind in exploring its potential. For instance, embedded finance has enabled new opportunities in the healthcare sector such as better health insurance coverage, transparent pricing, and multiple payment options. Similarly, in education, edtech players can use insights from embedded finance platforms to offer student-friendly loans that also mitigate the lender’s risk. Even in real estate, embedded finance can potentially transform the housing market. By eliminating lengthy documentation and integrating insurance, mortgage processes, and lending onto one platform can simplify home buying. The rise of open banking has also made these integrations more viable.

Understanding the embedded finance ecosystem

Four key players in the embedded finance ecosystem make these solutions possible – financial institutions, digital platforms, solution providers, and data enablers.

1. Financial Institutions such as banks, small finance banks, and Non-Banking Financial Institutions play a key role in enabling the embedded finance ecosystem. Their primary role is to utilize their network to handle the financing requests and manage regulatory, credit, and compliance risks.

2. Digital Platforms of businesses and non-fintech organizations such as websites, mobile apps, etc. are the face of the embedded finance ecosystem. This is where customers avail the customized financial services. Digital platforms will play pivotal roles in financial services distribution and create a new generation of innovative and effective financial products.

3. Solution providers are technology companies that provide the technology backbone of this ecosystem. They help integrate financial institutions and digital platforms and help develop standalone fintech products for enterprises.

4. Data enablers are the transporters of information between the solution providers and showcase platforms. Their technology infrastructure employs SDKs, APIs, and Banking as a Service.

Banks in the embedded finance future – “dumb pipes” or enablers of a new economy? In a survey[i] of fintech industry leaders, almost 38% of respondents said that “by 2030, banks would become like telecom operators – dumb pipes that provide basic services while consumers look elsewhere for specialized services.” But the future doesn’t have to be that bleak. In the same survey, over 51% of respondents also said that banks have the potential to become platforms that provide access to specialized fintech players. Which end of the spectrum they land on will depend on the steps banks take now. A new era of rapid development and competition is on the horizon, and technology will be the key component that bridges the gap between financial services and end consumers.