Why Sustainable Banking Makes Business Sense for Banks

The last few years have seen unprecedented momentum behind the environmental, social, and governance (ESG) goals of global businesses. And rightly so! Collectively we are facing the threat of climate change, natural disasters, and inequality. Markets, consumers, and policymakers expect companies to play their role in mitigating these risks, and banks are no exception.

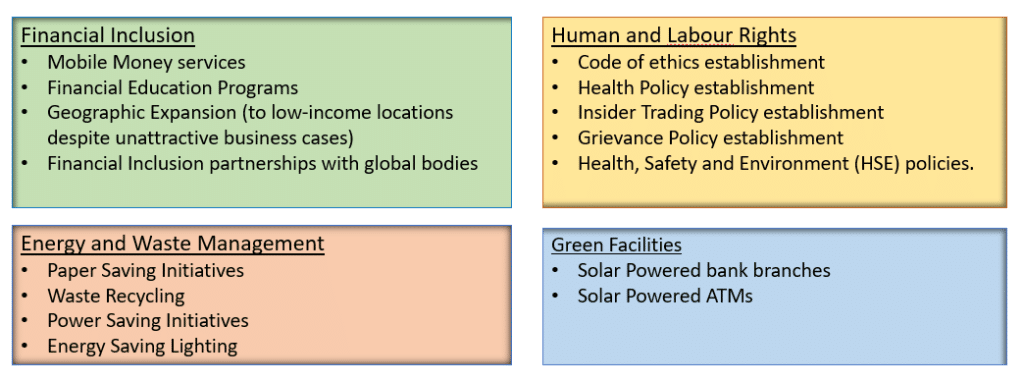

There is a spotlight now on sustainable banking (also called ethical or social banking) that pursues profit while prioritizing ESG responsibilities (see Fig 1). For instance, ensuring inclusive lending, investing in socially responsible and climate-friendly businesses, running green operations, investing in community development projects, and making ethical business decisions. Given the nature of business, banks are uniquely positioned to incentivize ESG practices by only agreeing to lend to invest in and insure businesses that manage their nature-related risks and impacts for broader societal benefits.

Benefits of sustainable banking

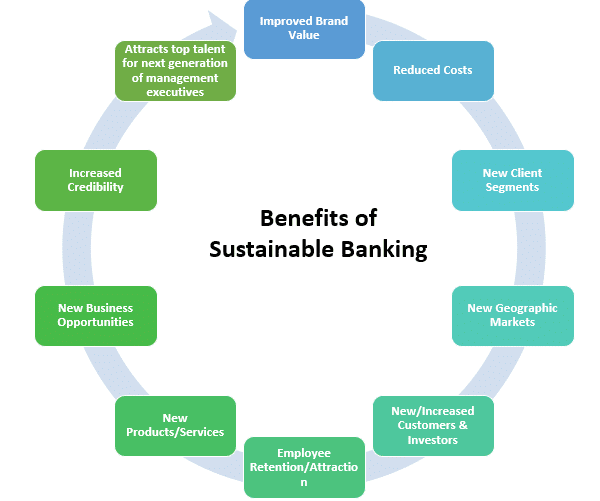

According to studies by the International Finance Corporation (IFC), banks have obtained several benefits from incorporating sustainability into their strategy and business practices, ranging from improved reputation to improved investor confidence. In addition, research by the Global Alliance for Banking on Values (a network of sustainable banks) has shown that sustainable banks have higher and more stable profits, as well as more robust growth than other banks.

There are indirect benefits too. For example, the Global Commission on Economy and Climate predicts that the transition to a low-carbon, sustainable economy could lead to an economic boost of US$26 trillion and create over 65 million new jobs by 2030. Economic growth translates to a boom in the banking sector. Another indirect impact is the mitigation of climate risk. For instance, crop failures resulting from climate change could lead to loans not being repaid. Similarly, wildfires or other natural disasters can damage assets.

In addition, banks that opt for sustainable practices significantly improve their brand value and customer trust. They have the opportunity to enter new markets and client segments and launch new products and services. Aligning with the values of the millennials and Gen Z also helps them attract top talent (See Fig 2).

Challenges on the road

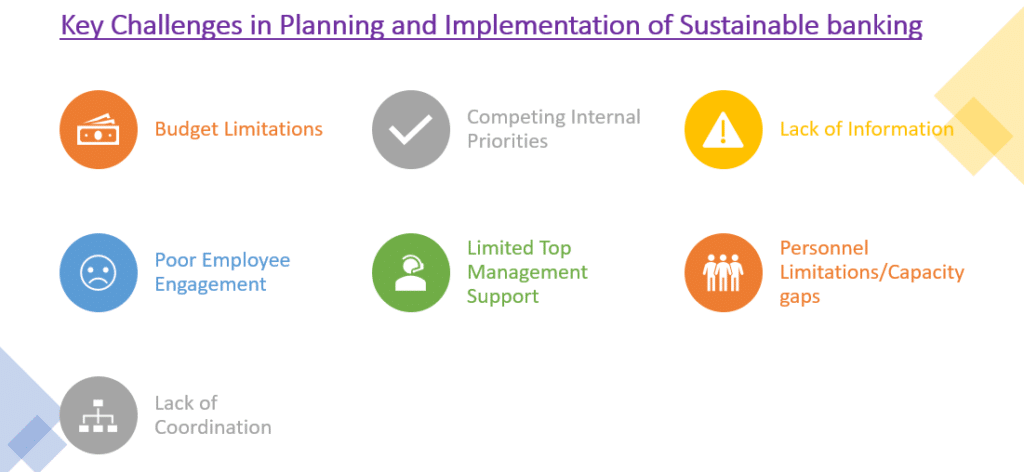

While a lucrative proposition, the road to sustainable banking practices is not easy (See Fig 3). Competing internal priorities, limited leadership support, prohibitive costs, and lack of a cohesive, collaborative effort towards a singular vision deter progress.

Banks’ response to ESG issues is also hampered by a lack of industry-specific standards and agreed-upon, relevant metrics or leading practices to guide them and establish credibility. In addition, the shortage of necessary data and lack of transparency makes benchmarking difficult, leaving banking leaders wondering, “Are we doing enough?”

On a regulatory front as well, there is a lot of scope for evolution. At present, there are no clear-cut standard regulations or regulatory bodies that a company should disclose its ESG information to. In addition, most of the regulations are voluntary and not mandatory.

Moving the dot on sustainable banking

To truly make sustainable practices business-as-usual, banks still have a long way to go and many roadblocks to overcome. But the need of the hour is to get started. In the next article, we’ll discuss what banks can do to adopt the sustainability agenda and how can they learn from those who have already made forays into this space.