The Rise of CBDCs: How Can Banks Prepare for The Next Crypto Wave?

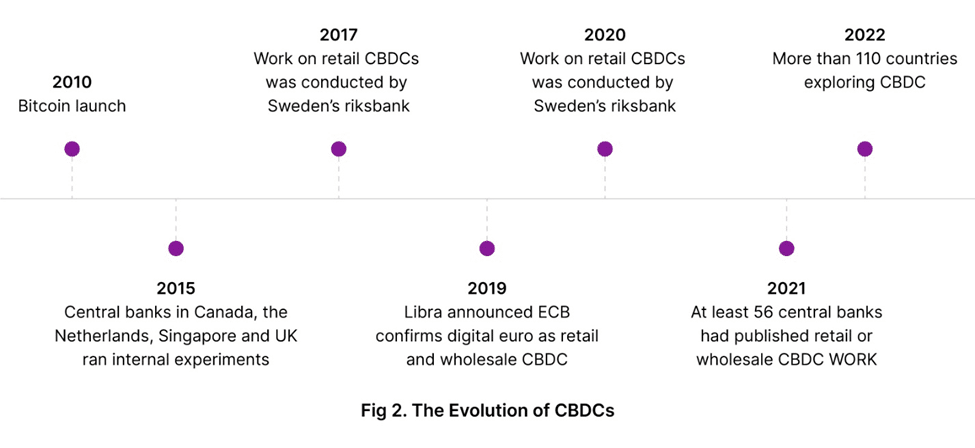

Although the concept of a central bank issuing digital currency is not novel, there was a surge of interest in the 1990s and 2000s, particularly among the general public for retail purposes. However, for several reasons, central banks decided against pursuing such initiatives.

Today, there is renewed interest in CBDC, which can be largely attributed to the emergence of blockchain technology and significant changes in both the global economy and the technological landscape. Blockchain-based CBDCs fall under the larger umbrella of ‘crypto assets’, and to understand the resurgence of CBDCs today it is necessary to look at the history of crypto assets in general.

Understanding A Decade of Crypto

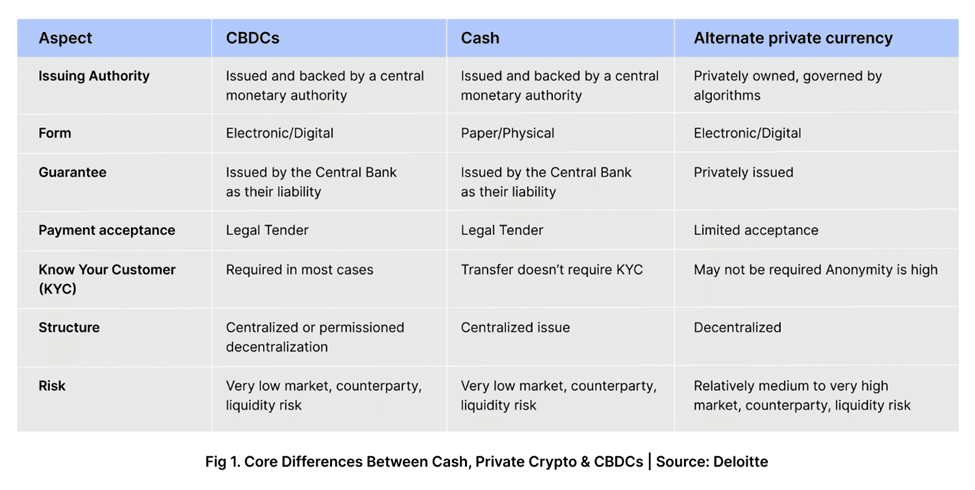

The first crypto asset was Bitcoin, “decentralized electronic cash system,” which billed itself as a new form of money whose main characteristics were that it was fully digital, lived on a blockchain, and was independent of any government or private institution. Quickly dubbed a ‘cryptocurrency’, it was followed by an explosion in similar blockchain-based cryptocurrencies known as altcoins.

In 2014 the Ethereum blockchain launched and was notable for adding new capabilities to blockchain based currencies, in particular full programmability on a blockchain allowing the creation of “smart contracts.”

Smart contracts made it possible to represent almost any asset, not just money, on a blockchain by means of a unique digital token (hence the term “tokenization”). But despite these advances, the volatility of cryptocurrency still made mainstream investors reluctant to engage. At the same time, transaction congestion on the major blockchains was pushing up transaction fees, putting a damper on cryptocurrency’s promise of speedy global transactions.

The first stable coins began appearing in 2017, with one of the most well-known early projects being Tether. These coins were generally focused on solving the payment problem for blockchain-based platforms specifically and were usually pegged to an external reference (like the US dollar) to reduce price volatility. As people began to understand the value of stable coins for tokenized asset markets, we have seen a second generation of stable coin projects by private and public entities, often as part of consortia and with the participation of technology providers.

Why are Central Banks so Interested in Cryptocurrency?

According to a 2021 survey, 86% of central banks are currently researching the potential for CBDCs.[1] Part of the reason for this interest, a CBDC offers an exciting opportunity for central banks to achieve various objectives while promoting sustainable economic growth.

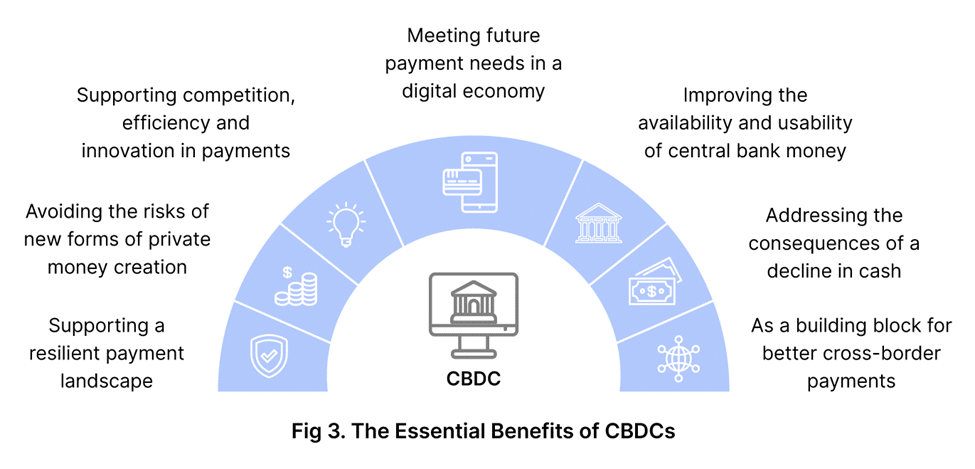

- CBDCs can eliminate the inefficiencies and costs associated with printing and transporting physical currency, delivering new payment capabilities and efficient government disbursements.

- CBDCs have the potential to modernize national payment systems, ensuring continued access to central bank money in a world where cash usage is declining.

- They also offer a chance to accelerate financial inclusion. Ensuring that every individual and household has access to financial services, especially for those who are economically vulnerable, is a top priority for many central banks. One way to achieve this is through private-sector electronic transactions accounts. Via CBDCs, these accounts offer numerous benefits such as easy access to digital payments, quick and cost-effective payment of taxes, speedy delivery of wages, tax refunds, and other federal payments, secure saving options, and improved access to credit. Individuals, businesses, and governments could potentially use a CBDC to make basic purchases of goods and services or pay bills, and governments could use a CBDC to collect taxes or make benefit payments directly to citizens.

- CBDCs also have the transformative power to revolutionize cross-border payments by leveraging cutting-edge technologies, introducing streamlined distribution channels, and fostering unprecedented opportunities for cross-jurisdictional collaboration and interoperability. CBDCs can even streamline bank-to-bank payments and financial market operations, ultimately providing a stable, secure alternative to volatile, unregulated cryptocurrencies that undermine trust in the monetary system.

However, realizing the full potential of CBDCs would require significant international coordination, especially to address critical issues such as establishing common standards and infrastructure, defining legal frameworks, and preventing illicit transactions.

How Can Banks Prepare for Mainstream CBDCs?

The success of CBDCs depends heavily on the active involvement of financial institutions and banks. Of course, not all financial institutions or banks will jump on the bandwagon at first, those with digitally savvy customers must be prepared to support them when CBDCs roll out.

Staying current with regulatory and tech updates: With more than 110 countries already developing their own CBDCs, the pressure is on to stay ahead of the curve. That makes it a smart move to stay on top of new regulatory and technological developments as banks need to make informed decisions about integrating their systems with the central bank’s. This is crucial to acquiring a first-mover advantage, and driving innovation in crypto-asset financing, especially given the pace of digital evolution today.

Investing in technology enhancements and partnerships: Besides systems integration and compliance, banks must also start thinking about how to integrate digital wallets for CBDCs into their systems. This means that fintech partners may play a critical role in helping banks with the right technology to ensure a smooth transition. By taking proactive steps now, banks can ensure that they are well-positioned to leverage the benefits of CBDCs and provide their customers with an optimal digital banking experience.

Honing your innovation edge: The digitization of currency has already transformed commercial banking and accounts for a significant portion of the global money supply. By leveraging programmable features at the commercial bank level, CBDCs can unlock new possibilities, empower banks to manage these features with greater flexibility, and streamline the overall ecosystem. With a strong foundation of basic currency infrastructure provided by central banks, CBDCs can serve as a catalyst for digital innovation, paving the way for exciting new financial products and services that benefit consumers and businesses alike. The possibilities are endless, and commercial banks that embrace the potential of CBDCs can lead the charge in shaping the future of finance.

CBDCs are Cresting the Horizon Across the Globe

Among economies around the world, there is growing recognition that CBDCs can enable governments to maintain their vital role as stewards of national currencies and economies. However, introducing CBDCs would require fundamental changes to the existing monetary system, raising important questions about economics, monetary policy, and legal framework.

While there are certainly regulatory loose ends involved in issuing CBDCs, central banks must carefully weigh these against the risks of not issuing them or doing so too slowly. Without CBDCs, the future of digital money would largely be in the hands of private issuers, potentially exposing businesses, and individuals to significant threat vectors. But by providing a secure, government-backed means of exchanging digital tokens, promoting financial inclusion, and potentially enabling new financial services and applications, central banks can lay the foundation for a digital monetary system that is safe, secure, and accessible to all.