Banking Basics: The Difference Between BaaS, Embedded Finance, and DeFi

The great shift to digital has upset quite a few apple carts, but perhaps none more so than financial services (FS). Today, legacy FS providers must contend with a flurry of new business models that threaten to erode their market share in favor of agile new digital finance companies. Just as the social media and search revolution turned every brand into a content producer, emerging developments in open banking and API technology are turning more and more non-financial firms into fintech companies.

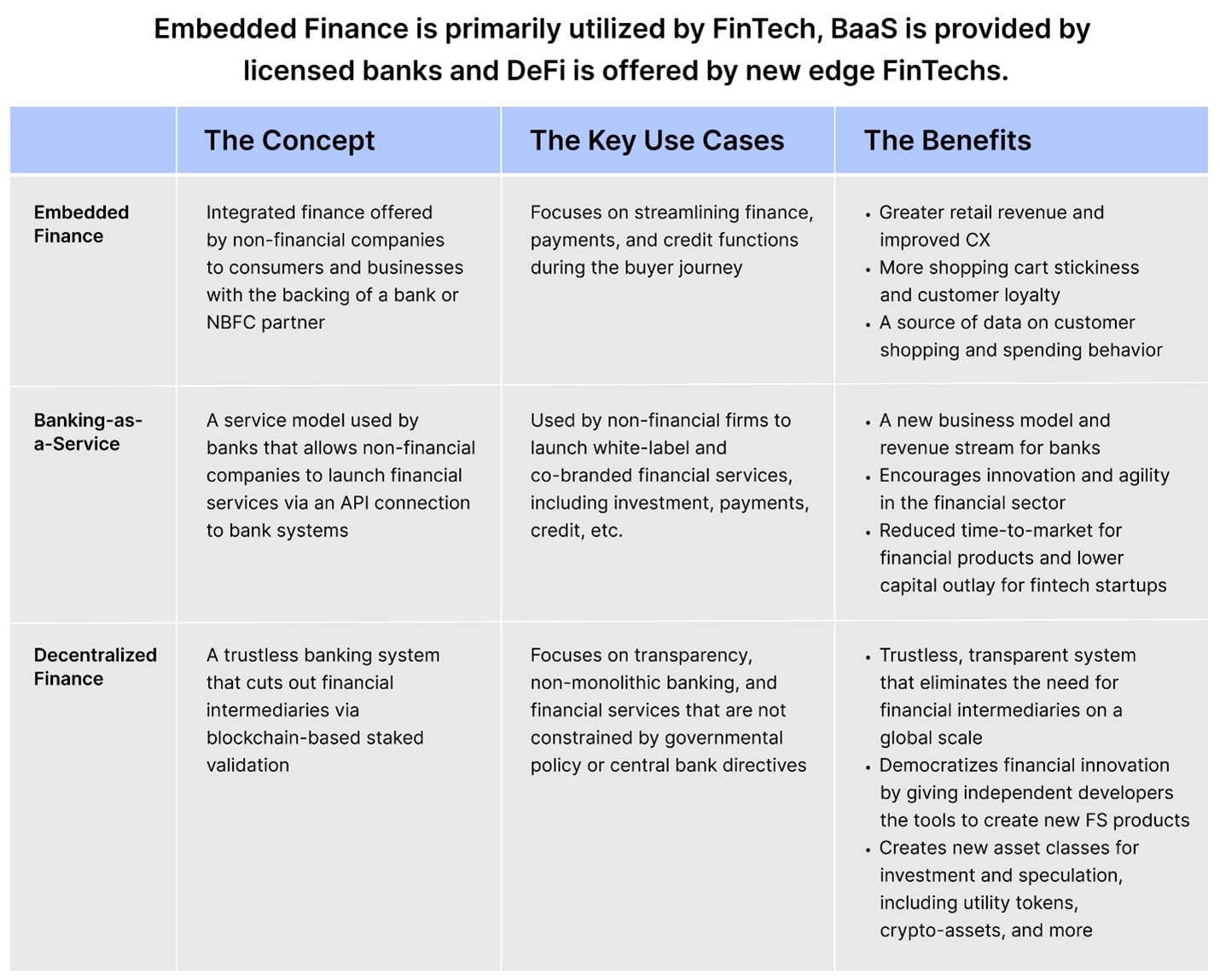

Underpinning this shift are three key concepts: banking-as-a-service (BaaS), embedded finance, and decentralized finance (DeFi). To the uninitiated, the overlap between these ideas may seem confusing, but for banking executives, each offers its own complexities and opportunities.

Embedded Finance

If you’ve ever used Uber Money to pay for your cab ride or Amazon Pay to make a purchase, then you’ve used embedded finance. The essential concept revolves around a non-financial company offering financial services on their customer channels via a partnership with a bank or NBFC. For brands, the benefits of EF are legion.

EF makes shopping faster by shortening the payment process. And since customers don’t have to navigate away from a channel to make a purchase, it reduces the risk of abandoned shopping carts. In addition, by integrating BNPL services directly on a retail app, brands can offer short credit lines directly to customers, eliminating the need for lengthy credit applications and credit app installations.

EF also extends beyond simple payments. Delivery service provider DoorDash, for example, offers DoorDash Capital. This lending service sits directly on the app and can be used by restaurateurs to tide over cash flow problems or expand their product offerings. Since DoorDash already has a ton of information on a given restaurant’s profitability via its delivery app, they’re uniquely positioned to assess risk parameters and approve loan amounts quickly. Not only do these embedded finance services make it easier for restaurants to thrive on DoorDash, but it vastly improves restaurant loyalty too.

Banking-as-a-Service:

BaaS is what makes embedded finance possible. It’s a banking model where FS providers extend access to their product and service portfolio to non-financial companies via APIs. This enables banks to offer white-label or co-branded payment, deposit, and investment services directly to non-banking firms. The result is that a whole assortment of companies can launch financial services on their own platforms using their banking partner’s charter and back-end systems rather than having to create that infrastructure themselves. Examples include white-label payroll management, tax services, and company credit cards.

The growth of BaaS has mirrored the rise of virtual banks that lack physical locations. Instead, virtual banks focus on creating a highly engaging customer experience while partnering with a licensed bank for compliance and back-end processing.

Decentralized Finance

A fast-growing niche within the FS industry, DeFi takes a different approach to banking than the traditional financial system. The concept leverages digital ledger technology, or blockchain, to tokenize everything from payments to loans, and has the potential to eliminate banks as financial intermediaries.

The transparency and lack of bureaucratic red tape inherent to DeFi is a major part of its appeal. Since all transaction data is immutably stored on the blockchain, DeFi offers an alternative model that many see as free of government or corporate influence. And since transactions are validated by staked users on the blockchain network (like Ethereum), typical banking institutions are cut out of the picture.

The rise of these technologies and trends is likely to change the status quo among FS providers and create new competitive markets within retail and business banking. But sharp FS leaders will quickly realize the partnership possibilities inherent to all three (EF, BaaS, and DeFi) and work to align and adapt their offerings with what might well be the future of finance.