Capital Market Operations Transformation: Why Multiprong Approach is the Need of the Hour

Moving over the traditional approach and embracing a diverse set of methods and tools for effective capital market transformation.

The truth. Most banks stand at the crossroads of capital market transformation, viewing it as a monumental challenge with limited options, often leading to the traditional path – outsourcing.

Well, while outsourcing may seem like an easy solution, it may not yield the right results considering the same inefficiencies of the processes still reside. Above all, rooting for a single approach to capital market operations transformation may not yeild required benefits. This blog offers a different perspective on capital market operations transformation, one that involves embracing a diverse set of methods and tools, such as AI, RPA, analytics, and some propitious set of modules.

These terrific tools, coupled with the suitable modules, can make your operations within capital market journey, a walk in the park. We at SLK show you how to revolutionize capital market operations in the fastest and most cost-effective way.

Inclusive Innovation: Using Varied Approaches

Here are the different gears you can employ to facilitate capital market operations transformation. From analytics and AI to RPA, each tool has a specific role to play in the transformation process, reducing costs and addressing critical business cases. Also, incorporating the “Human in the Loop” approach can address complexities and how grouping similar processes can streamline operations.

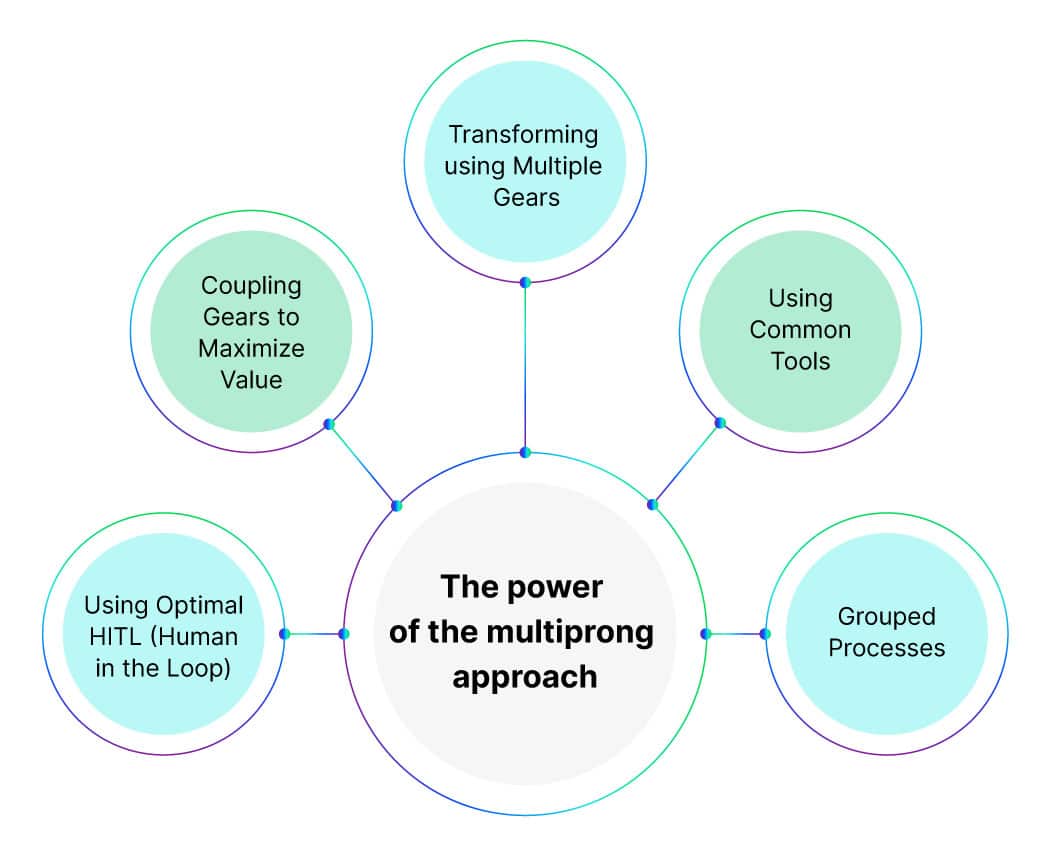

The power of the multiprong approach

- Transforming using Multiple Gears: In the race to modernize capital market operations, banks must look beyond a single tool or approach. Analytics can significantly enhance processes like cost standardization. AI proves invaluable when evaluating variables like PD (Probability of Default) and LTV (Loan-to-Value ratio). Meanwhile, RPA can be a game-changer for streamlining processes such as Product to Cash. The key is to identify the most suitable tools for each task and harness them holistically.

- Coupling Gears to Maximize Value: It’s all about synergy. Banks can create powerful combinations by integrating AI, analytics, and automation. Analytics driven by AI can tackle complex tasks like regulatory compliance, particularly when it comes to swap deals and Volcker rules. Adding automation to the mix enhances processes like KYC (Know Your Customer) and collateral management, making the whole greater than the sum of its parts.

- Using Common Tools: Why reinvent the wheel? Leveraging existing modules, like those for client onboarding, reconciliation, KYC, AML (Anti-Money Laundering), and financial/regulatory reporting, designed for other banking functions, can significantly reduce implementation costs and address crucial business cases.

- Using Optimal HITL (Human in the Loop): Sometimes, a human touch is irreplaceable, especially in complex operations. Integrating transformation tools with optimal HITL can help address the nuances of various processes and make informed decisions. Tasks like trade execution, LOC (Letter of Credit) review, and fund settlement instructions thrive under this dynamic combination, with AI/RPA handling the heavy lifting while HITL ensures the proper linkages.

- Grouped Processes: Think of it as bundling similar processes. For instance, document management in security services, brokerage services, tax operations, and more can be grouped together. Even though these areas have distinct scopes and data requirements, they share common activities such as reconciliation, account opening, and reporting. By categorizing processes in this way, banks can employ AI/ICR (Intelligent Character Recognition) enabled tools to support them more efficiently.

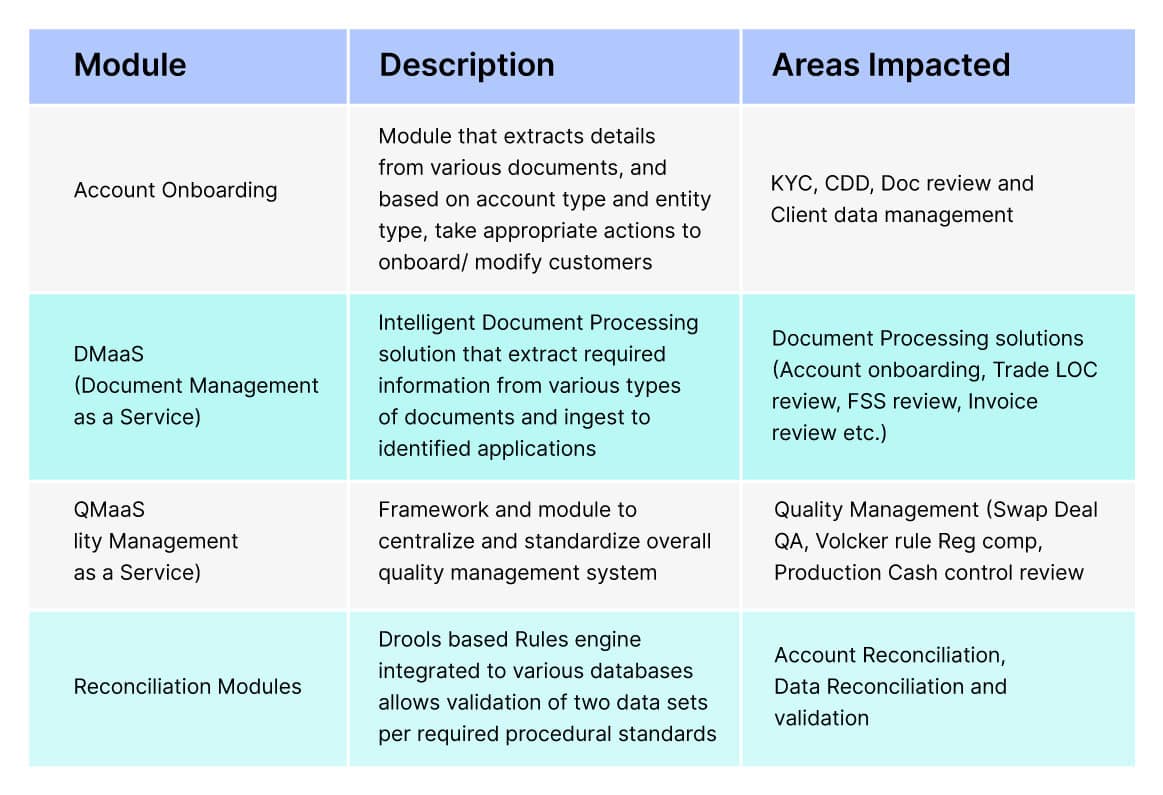

Modules in Action: Streamlining Capital Market Processes

Here, we focus on the practical implementation of transformation. Customized and pre-built modules can significantly improve processes like account opening and data extraction. We’ll explore how these modules can be customized to suit specific needs, saving time and reducing costs.

Consider, for instance, the process of account opening or data extraction. There are modules that are designed to extract data from various documents. Whether it’s opening a broker account, capital market account, or retail account, these modules can adapt to different document types, extracting the relevant information. Instead of building new modules from scratch, we can integrate these existing modules with APIs into your systems, streamlining the process through RPA bots.

The result? Reduced costs, streamlined operations, and faster service delivery.

Reconciliation is another prime example. Different sets of data require distinct methodologies. By employing pre-built modules that can be customized to fit specific needs, we minimize effort, expedite issue resolution, and reduce costs. Reconciliation for fund settlements, annuity claims, and payments can all benefit from this approach, each with its own tailored methodology.

The advantages of using these modules are clear

- Reduced efforts: You’re working smarter, not harder.

- Faster issue resolution: Time is of the essence in the capital markets.

- Lower costs: Achieving efficiency while keeping expenses in check.

Partnering with SLK: Tailored Solutions for Capital Market operations Transformation

At SLK Software, we specialize in supporting customers in their capital market operations journey. Our differentiator lies in the customization of solutions to meet the unique needs of our clients. Be it a simple process transition or a complete overhaul through process re-engineering tools, we adapt our approach to help banks achieve compliance, mitigate risks, and enhance customer satisfaction within capital market operations.

Conclusion

The key takeaway is that transformation is not a one-size-fits-all solution, and the combination of tools and methodologies should be tailored to the specific needs of each financial institution. SLK Software is here to facilitate this transformation, offering customized solutions and expertise that cater to the dynamic world of capital market operations.

In a fast-changing environment, the ability to adapt and evolve is the true hallmark of a successful capital market operation. By embracing these diverse strategies, banks can navigate the complexities of modern finance with confidence and competence, all while serving their clients more efficiently than ever before.

Evaluate your corporate market transformation plan and get opinion from the subject matter experts. Get in touch with us now.